L'art, un refuge

en temps de crise ?

A l’heure où j’écris ces lignes, je ne sais pas si vous les lirez assis à une terrasse de café, au restaurant à votre pause de midi ou… en confinement chez vous. En effet, ce dernier trimestre 2020 se caractérise par l’incertitude : sur nos perspectives de mobilité, sur les règles de protection à adopter, avec pour conséquence un impact sur l’économie et le fonctionnement de ses marchés. Dur constat après une année déjà bien compliquée. Néanmoins, certains secteurs sont moins touchés que d’autres, parmi lesquels l’Art. Nous vous invitons à déceler les opportunités potentielles dans cette nébuleuse.

14 mai 2022

L’Art comme valeur refuge en temps de crise

Dans un article de l’Obs, Thierry Ehrmann fondateur de la plateforme Artprice, nous explique que le marché de l’art est le premier marché à avoir été mondialisé.

« C’est un marché qui ne connait pas de crise parce qu’il est mondial. Même s’il se replie parfois dans certaines zones du monde, il y a toujours un équilibre. Un Chagall reste un Chagall qu’on soit en Amérique du Sud, à Atlanta, à Johannesburg ou à Kiev, il vaut toujours le même prix. »

Le marché de l’art s’est extrêmement développé ces dernières années. Le nombre collectionneurs se compte aujourd’hui en millions et continue à croitre.

Comme nous l’avions illustré dans notre article en septembre dernier, les artistes contemporains continuent de produire des œuvres et depuis le début de la période de confinement, les ventes d’art en ligne ont progressé de manière constante. Il en résulte que le marché de l’art est plutôt épargné par l’irrationnalité qui touche les marchés boursiers ou immobiliers, et ainsi se distingue. Il s’agit dès lors d’en connaitre les codes et le fonctionnement, afin d’avoir toutes les cartes en mains pour faire les bons choix.

L’art contemporain, un investissement plaisir

Avant d’avoir une valeur marchande, une œuvre d’art a d’abord une valeur esthétique. La détermination de sa valeur marchande ressemble à celle de tous les autres investissements : la loi de l’offre et de la demande, à la différence près que l’on y ajoute des éléments subjectifs.

Les principaux acteurs de la valorisation des œuvres d’art sont d’une part les institutions culturelles qui regroupent les grands collectionneurs, les musées, les critiques d’art, et d’autre part les institutions financières qui sont constituées de marchands d’art, de galeristes, de courtiers et autres commissaires-priseurs.

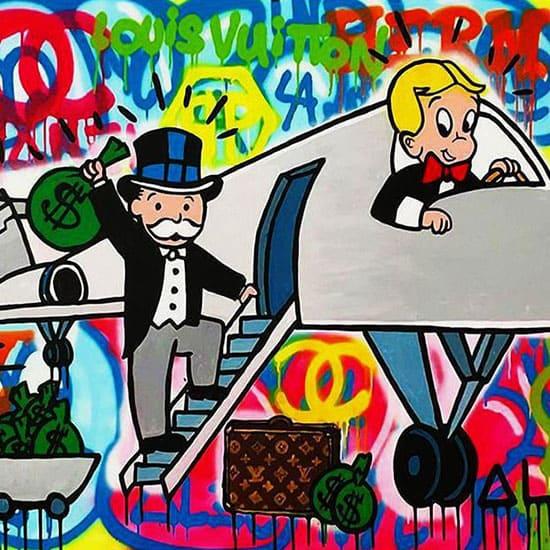

Aujourd’hui, notamment avec l’ampleur que prennent les réseaux sociaux, la popularité des artistes est tout à fait susceptible d’influencer la croissance de leur cote, comme le démontre l’évolution de celle d’Alec Monopoly ces dernières années.

Quand il s’agit d’investir, l’objectif est donc d’anticiper les tendances à venir mais aussi de connaitre l’environnement de l’artiste (son équipe, ses mécènes), ses projets, ses perspectives, pour ensuite choisir ou commander les œuvres qui seront importantes dans le futur et génèreront un retour sur investissement important.

Une fiscalité avantageuse dédiée aux acquéreurs d’œuvres d’art : professionnels et particuliers

Chaque pays dispose de sa propre législation qui confère des avantages en fonction de la situation de chacun.

A titre d’exemple, en France, les sociétés soumises à l’IS ou l’IR peuvent bénéficier d’une déduction d’impôts calculée en fonction de leur chiffre d’affaire. L’œuvre d’art doit être réalisée par un artiste vivant au moment de l’achat et être exposée dans les locaux de l’entreprise ou prêtée à une institution culturelle où elle sera accessible, et ce pendant 5 ans. A l’issue de cette période, si l’entreprise réalise une plus-value lors de la revente de l’œuvre d’art, l’imposition est aussi avantageuse.

Par conséquent, il est possible de se distinguer de la concurrence, d’asseoir son image de marque, en acquérant une œuvre d’art particulière, de promouvoir un artiste, de soutenir la culture, tout en réalisant des bénéfices.

Bien sûr, il y a d’une part des conditions à respecter et d’autre part une sélection d’œuvres d’art judicieuse à faire. Néanmoins, il s’agit bien là d’une opportunité gagnante (et plaisante !) pour chacun.

L’Art comme possibilité de placement

Selon la démarche de chacun, investissement ou placement, l’acquisition d’une œuvre d’art est une façon de diversifier et de sécuriser son patrimoine.

Pour réaliser un placement, on favorisera le choix d’une œuvre de Grand Maître (art classique ou moderne). En effet, comme expliqué précédemment, c’est un consensus de professionnels qui valorisent ces œuvres de Picasso, Chagall ou Van Gogh… Pour ces chefs-d’œuvre d’une grande valeur culturelle, patrimoniale et financière, les circuits sont courts et le risque limité étant donné leur renommée internationale, néanmoins le ticket d’entrée est réservé aux plus fortunés d’entre nous.

Cela fait sept mois que le monde essuie une crise sanitaire qui a un impact anxiogène sur les marchés, dans nos villes, nos pays et chez nous. Chacun tente de trouver les ressources afin de préserver sa sécurité économique mais aussi de prendre soin au mieux de sa santé physique et mentale. L’art sous toutes ses formes est une réponse possible, à tout niveau.